Step-by-Step Guide to Starting a Business in Singapore

Learn how to start a business in Singapore with our step-by-step guide. Discover the company registration process, costs, and tips for a smooth setup.

Starting a business in Singapore is an exciting opportunity, thanks to its thriving economy, strategic location, and business-friendly environment. Ranked second in the World Bank’s Ease of Doing Business Index (2020), Singapore has become a preferred destination for entrepreneurs and investors globally. This guide provides a detailed overview of the company registration process, making it easier for you to establish your business in one of the world’s most dynamic economies.

Why Singapore Is Ideal for Starting a Business

Singapore is a global business hub, attracting companies with its innovative policies and favorable ecosystem. Here are some reasons why entrepreneurs choose Singapore:

-

Low Corporate Tax Rates: The corporate tax rate is capped at 17%, one of the most competitive rates in the world. Additionally, startups can benefit from tax exemptions, with new companies enjoying a 75% tax exemption on their first SGD 100,000 of taxable income for the first three years.

-

World-Class Infrastructure: Singapore offers state-of-the-art infrastructure, from advanced technology systems to efficient transport networks, ensuring seamless business operations.

-

Strategic Location: Positioned at the heart of Asia, Singapore provides access to 3 billion people within a seven-hour flight radius, making it a gateway to expanding into Asian markets.

-

Transparent Regulatory Framework: With its highly transparent legal system, Singapore ensures ease of compliance, making it ideal for foreign investors.

These factors, coupled with Singapore’s emphasis on innovation and its startup-friendly policies, make it a prime location for businesses of all sizes.

Step-by-Step Process for Company Registration in Singapore

Registering a company in Singapore involves several key steps, each of which is straightforward if you’re well-prepared.

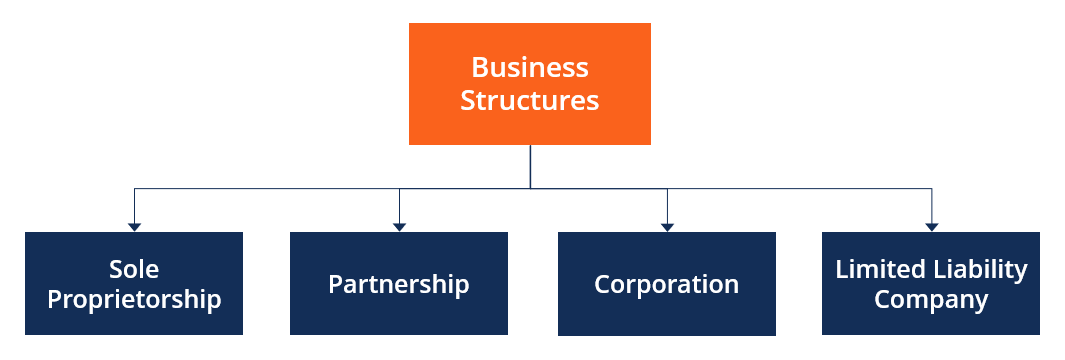

(a) Choose the Right Business Structure

Your choice of business structure determines your company’s legal and operational framework. The most common types in Singapore include:

- Private Limited Company (Pte Ltd): The most popular option for local and foreign entrepreneurs. It offers limited liability protection and allows for raising funds through issuing shares.

- Sole Proprietorship: Ideal for small businesses but lacks separation between personal and business liabilities.

- Limited Liability Partnership (LLP): Suitable for professional firms or partnerships that require a flexible structure.

According to ACRA (Accounting and Corporate Regulatory Authority), over 60,000 companies are registered annually in Singapore, with most choosing the Pte Ltd structure due to its flexibility and benefits.

(b) Reserve a Company Name

Choosing a unique and compliant name is critical. ACRA oversees the approval of company names, and the process involves:

- Ensuring the name is not identical to existing companies.

- Avoiding restricted or sensitive words (which may require special permission).

The approval is typically completed within a day. If you’re unsure about the process, services like Osome can help streamline name reservations, ensuring compliance with all requirements.

(c) Register Your Company

Once your name is approved, you can proceed with company registration. The documents required include:

- Approved company name

- Details of shareholders, directors, and the company secretary

- Constitution of the company (previously known as the Memorandum & Articles of Association)

- Registered office address in Singapore

The registration fee with ACRA is SGD 300. According to official data, the entire process can be completed in as little as 1–2 business days if all documents are in order.The registration process is entirely online and usually takes 1–2 business days. The cost is approximately SGD 300. Platforms offering assistance in company registration in Singapore can simplify this step by managing paperwork and compliance.

(d) Open a Corporate Bank Account

A corporate bank account is mandatory for managing your business finances. Some of Singapore’s leading banks include DBS, OCBC, and UOB. To open an account, you’ll need:

- ACRA-issued certificate of incorporation

- Company constitution

- Passport details of directors and authorized signatories

Opening a bank account usually takes a few days, depending on the bank’s requirements.

(e) Fulfill Compliance Requirements

Singapore has strict compliance regulations, ensuring transparency and accountability. Here are key obligations for businesses:

- GST Registration: Required if your annual turnover exceeds SGD 1 million. Companies with lower turnover may register voluntarily to claim GST refunds.

- Annual Filing with ACRA: Submit annual returns, including audited or unaudited financial statements, within seven months of the financial year-end.

- Employment Pass: Foreign entrepreneurs planning to relocate to Singapore must apply for an Employment Pass or Entrepreneur Pass.

Real Also: Step-by-Step Guide to Buying Property in Sydney, Australia

Common Challenges in Registering a Company

Despite the straightforward process, entrepreneurs may encounter challenges, such as:

- Name Rejections: Names that are too similar to existing entities often face delays.

- Meeting Compliance Standards: First-time entrepreneurs may find it difficult to navigate Singapore’s legal and tax requirements.

- Local Director Requirement: Foreigners must appoint at least one local director, as mandated by ACRA.

These challenges can be mitigated by using professional services, ensuring that your registration process is smooth and error-free.

Cost Breakdown for Starting a Business in Singapore

Understanding the costs involved helps with planning. Here’s an estimate:

| Expense | Approximate Cost (SGD) |

|---|---|

| Company Name Reservation | 15 |

| Company Registration Fee | 300 |

| Registered Address Services | 120–400 annually |

| Corporate Secretary Services | 600–1,200 annually |

| Opening a Corporate Bank Account | Free (depending on bank) |

This breakdown gives entrepreneurs a clear picture of the financial commitment required.

Tips for First-Time Entrepreneurs

- Plan Ahead: Have all documents ready to avoid delays during registration.

- Engage Professionals: Consider hiring professional services to handle compliance and registration.

- Leverage Technology: Use accounting and compliance tools to streamline operations.

Conclusion

Singapore is a prime destination for entrepreneurs looking to establish a business in a globally connected and innovation-driven environment. Its strategic location, low tax rates, and transparent regulatory framework make it an ideal place to start and grow a company. By following the steps outlined in this guide and staying informed about compliance requirements, you can set up your business smoothly and efficiently.

With proper planning and the right approach, you can leverage Singapore’s vibrant business ecosystem to achieve your entrepreneurial goals. Whether you’re launching a startup or expanding an existing enterprise, Singapore offers the tools and opportunities to help your business thrive.

FAQs

Q1: Can foreigners register a company in Singapore?

Yes, foreigners can register a company in Singapore. However, they must appoint at least one local resident director as per ACRA regulations. This can be a Singaporean citizen, permanent resident, or a person with an Employment Pass.

Q2: How much does it cost to register a company in Singapore?

The registration fee is approximately SGD 300. Additional costs include registered address services, corporate secretary services, and opening a corporate bank account, which vary depending on your provider.

Q3: How long does the registration process take?

If all documents are in order, the process can be completed within 1–2 business days. Name approval, however, may take additional time if the name is flagged for review.

Q4: Is GST registration mandatory for all companies?

GST registration is only mandatory if your annual turnover exceeds SGD 1 million. Companies with lower turnover can register voluntarily to benefit from GST refunds on business expenses.

Q5: What is the most popular business structure in Singapore?

The Private Limited Company (Pte Ltd) is the most popular structure due to its flexibility, limited liability, and ability to raise capital through shares.