Starting a business is exciting, but you need money to make it work. This money, often called startup capital or start up capital, helps pay for things like rent, equipment, salaries, and marketing before your business starts earning money. If you’ve ever wondered what is startup capital or what is start up capital in business, this guide explains it in simple terms. We’ll also cover why it’s important and how to get it. Whether you’re starting your first business or launching a new venture, this article will show you how to find the money you need to get started.

What Is Startup Capital?

Types of Startup Capital

How to Calculate How Much Startup Capital You Need

Where to Find Startup Capital

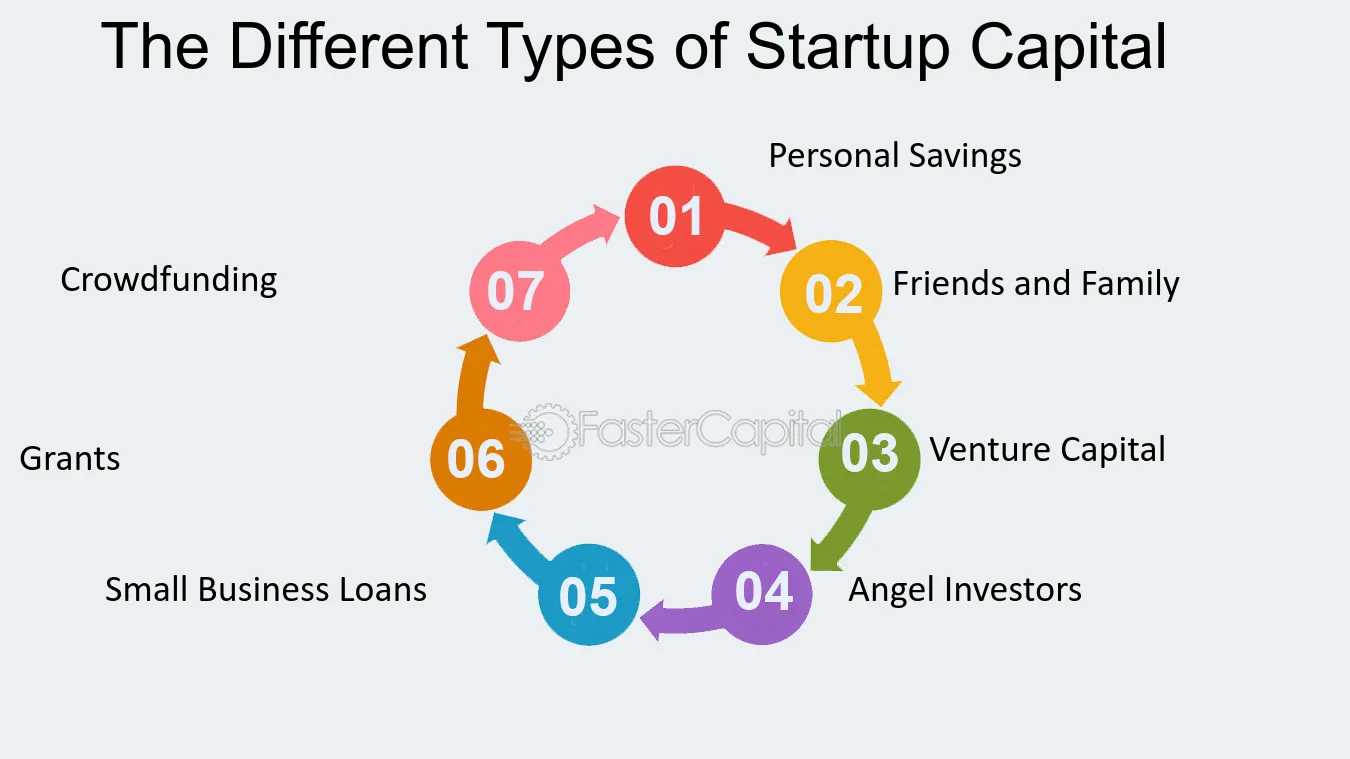

Once you know how much business start up capital you need, the next step is finding it. Here are the most common sources:

-

Angel Investors: Wealthy individuals who invest their own money in new businesses. They often provide guidance and support in addition to funding.

-

Venture Capitalists (VCs): Professional investors who fund high-growth businesses in exchange for a share of the company.

-

Crowdfunding Platforms: Websites like Kickstarter and Indiegogo let you raise money from a large number of people, which works well if your product has broad appeal.

-

Government Grants and Loans: Some governments offer grants or low-interest loans to support new businesses, often in specific industries such as technology or green energy.

-

Bank Loans: Traditional bank loans require a good credit history and must be repaid with interest.

Whether you need startup capital for business or are planning to raise capital for startup through investors, research each source carefully. Each option has its own requirements, so choose the one that best matches your business goals.

Pros and Cons of Different Startup Capital Options

Here’s a quick look at the pros and cons of the most popular ways to get startup capital. Each startup capital option has its own advantages and disadvantages, and understanding them can help you make better capital raising for startups decisions:

Bootstrapping

Pros: Full control of your business. No need to repay loans or give up ownership.

Cons: Limited funds. Higher personal risk if the business struggles.

Venture Capital

Pros: Large investments and access to expert advice and valuable connections.

Cons: You give up some control and face high pressure to grow quickly.

Crowdfunding

Pros: You keep full ownership and can prove market demand if people are willing to fund you.

Cons: Campaigns can take time and may not raise enough money.

Bank Loans

Pros: You keep full ownership and benefit from predictable repayment terms.

Cons: Requires good credit and collateral, and you must repay with interest.

Understanding the pros and cons will help you choose the funding method that best suits your business.

Read More:Step-by-Step Guide to Starting a Business in Singapore

How to Approach Investors

If you want to raise money from investors, you need to be well-prepared. Here’s how to get started:

Create a Pitch Deck: A pitch deck is a short presentation (usually 10–15 slides) that explains your business, product, and financial plan. It should grab investors’ attention quickly.

Show the Market Opportunity: Investors want to see that there’s demand for your product or service. Research your market and be ready to explain how you’ll stand out from competitors.

Have a Strong Value Proposition: Explain what makes your business special. Investors are more likely to fund businesses that solve a real problem or offer something new.

Being well-prepared increases your chances of raising startup capital from investors and avoiding costly mistakes.

Common Mistakes to Avoid

There are common mistakes entrepreneurs make when raising capital for startups. Here’s how to avoid them:

Underestimating Costs: Many startups fail because they run out of money too soon. Make sure your estimates are realistic, and include extra funds for unexpected expenses.

Giving Away Too Much Equity: Avoid giving up too much ownership of your business in exchange for funding, as this can cause you to lose control of your company.

Focusing Only on Money: While funding is important, mentorship and networking opportunities that come with some investors can be just as valuable.

By avoiding these mistakes, you can improve your chances of raising the right amount of startup capital.

Startup Capital Trends to Watch in 2025

The world of startup capital is evolving, with new opportunities for raising capital for startups emerging every year. Here are some trends to watch in 2024:

Sustainability and Social Impact: More investors are looking for startups that focus on environmental or social issues. If your business has a positive impact, you could attract these investors.

Decentralized Finance (DeFi): Blockchain technology is changing how businesses raise money through decentralized finance, allowing startups to get funding without relying on banks or venture capitalists.

Equity Crowdfunding: This is becoming a popular way for people to invest small amounts in exchange for shares in a company. Platforms like Seedrs and Crowdcube make it easier for everyday people to invest in startups.

These trends could offer new opportunities for startups to raise capital in creative ways.

Conclusion

Securing startup capital—whether through startup capital funding, loans, or personal savings—is one of the most important steps for a business. Whether you decide to bootstrap, seek venture capital, or try crowdfunding, each option has its pros and cons. By understanding your funding needs, preparing a solid plan, and avoiding common mistakes, you can set your business on the path to success. Explore all your options and choose the one that’s right for you.

FAQs

What is startup capital, and why do businesses need it?

Startup capital is the money a business needs to cover early expenses like rent, equipment, and marketing. Without enough capital, it’s hard to get a business off the ground.

What are the best sources of startup capital?

Some common sources include personal savings, venture capital, angel investors, crowdfunding, and business loans. The best source depends on your business type and financial needs.

Can a business succeed without startup capital from outside?

Yes, some businesses can succeed by bootstrapping, which means using personal funds. However, securing external capital can help a business grow faster.

What are the risks of using venture capital?

The biggest risks include losing control of the business and facing pressure to grow quickly. Venture capitalists often expect fast results and high returns.